Privacy, Compliance & Control: A CFO’s Guide to POPIA/GDPR-Ready CRM Automation

Privacy, Compliance & Control: A CFO’s Guide to POPIA/GDPR-Ready CRM Automation

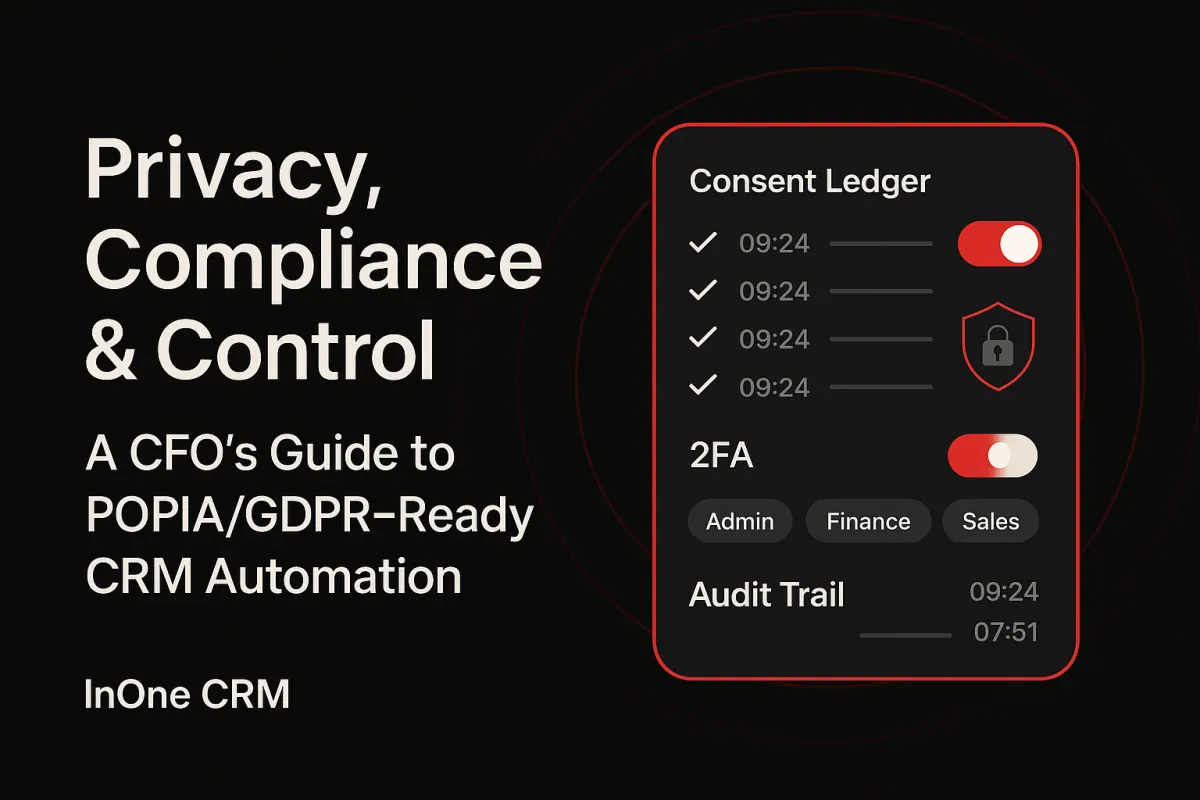

Automation and compliance can (and must) coexist. For finance leaders, the question isn’t “should we automate?” but “can we automate without increasing risk?” InOne CRM is engineered with privacy by design, giving CFOs the governance levers they need—consent management, role-based access control (RBAC), field-level encryption, 2FA, and exportable audit trails. The result is a scalable revenue engine that meets POPIA- and GDPR-aligned expectations while improving close rates and operational efficiency.

Control Points that let Finance Say “Yes”

Consent Ledger. Every opt-in and purpose (marketing, support, billing) is captured with timestamps, channel details, and proof. Revocations propagate instantly, so workflows stop or adapt automatically. This protects sender reputation and ensures consent management is demonstrable to auditors.

RBAC & Least-Privilege. Access to contacts, deals, and documents is limited by role, team, and territory. Sensitive fields (ID/passport, payment references) can be masked or hidden entirely. Approvals and exports require privileges, creating separation of duties that finance teams expect.

Encryption & 2FA. Customer data is protected at rest and in transit. Two-factor authentication reduces account-takeover risk, while scoped API keys ensure integrations touch only what’s necessary. Together these measures deliver a truly encrypted CRM experience.

Audit Trails. Every view, edit, export, send, and deletion is time-stamped, linked to a user, and tied to the workflow that triggered it. When Legal asks “who changed this value and when?”, you have the answer in seconds.

Implementation Checklist (CFO-friendly)

Map data categories & legal bases. Identify which fields you collect, why you collect them, and who is allowed to see them.

Enforce roles and data minimisation. Lock down sensitive fields; collect only what’s needed for the stated purpose.

Activate consent checks inside workflows. Every automation must verify lawful basis before messaging or processing.

Set retention & redaction rules. Define how long data lives and when it’s anonymised or deleted.

Review quarterly with Reporting & Analytics. Track opt-ins, opt-outs, access events, exports, and exceptions.

How Automation Stays Compliant

With InOne CRM, the same workflows that increase revenue also enforce policy. Chatbots and AI callers verify consent before proceeding. Follow-ups reference preferences and quiet down after silence. Document capture requests only the missing items and stores them against the correct record with role-restricted access. Meanwhile, audit trails and exceptions feed dashboards so Finance can sample, test, and certify controls continuously.

KPIs Finance Should Monitor

Consent coverage (percentage of active records with valid purposes)

Access violations (should be zero; alert on attempts)

DSAR response time (find, export, and fulfill subject-access requests fast)

Encrypted-field adoption (sensitive fields correctly protected)

Export events per month (trend and justify large extractions)

Why this matters for margin and risk

A POPIA compliant CRM reduces exposure to fines and reputational damage while enabling faster, cleaner revenue operations. Sales moves quickly; Finance sleeps at night. The win is not just safety—it’s speed with safeguards, where every automated touch is provably lawful, necessary, and documented.

FAQ

Q: Where is data stored?

A: Secure cloud infrastructure with data encrypted at rest and in transit, plus enforced 2FA for user access.

Q: Can Legal review logs easily?

A: Yes. You can export audit trails per contact or workflow, including timestamps, actors, and actions.

Learn more…

https://inonecrm.com/home-7638-3783